39 define zero coupon bond

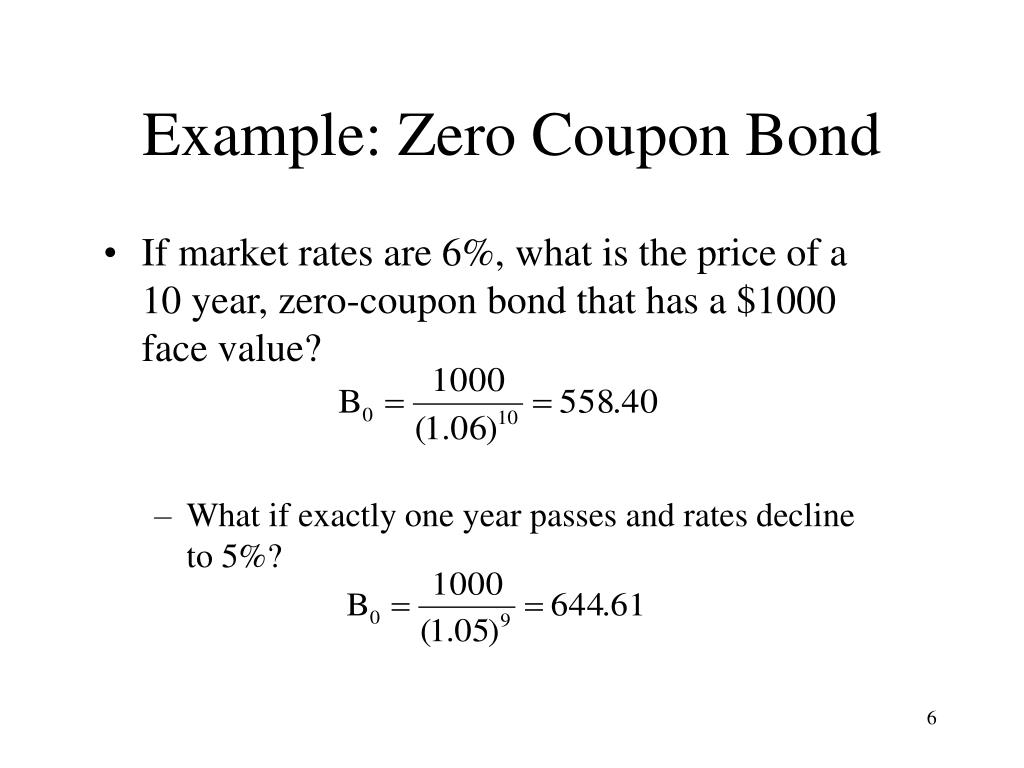

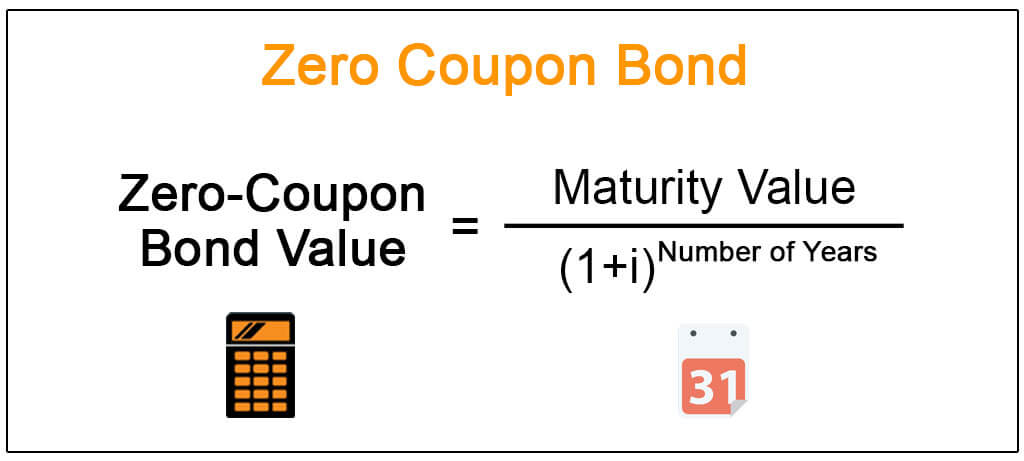

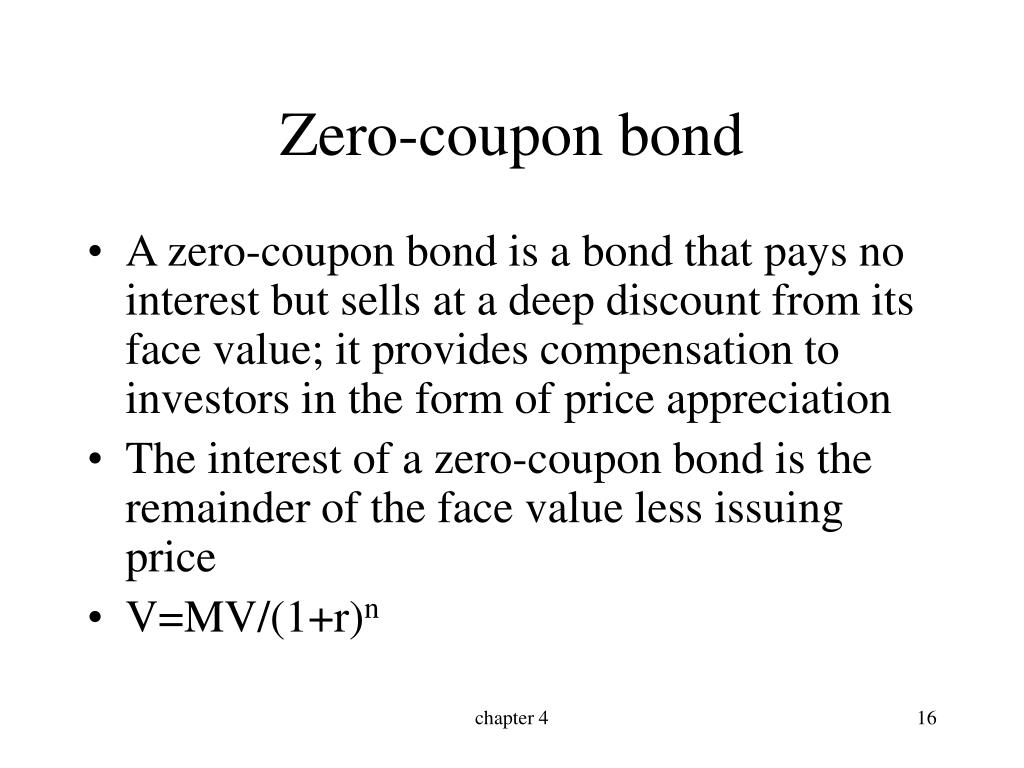

Zero Coupon Bonds financial definition of Zero Coupon Bonds Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates. Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a "T-Bill," a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Zero-Coupon Bond Price Formula

What does zero coupon bond mean? - definitions Definition of zero coupon bond in the Definitions.net dictionary. Meaning of zero coupon bond. Information and translations of zero coupon bond in the most comprehensive dictionary definitions resource on the web.

Define zero coupon bond

Zero-coupon bond - definition of zero-coupon bond by The Free Dictionary zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero coupon bond What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a bond that doesn't result in recurring interest income for the bondholder. The owner buys the bond at a discount, and the difference between the bond's purchase price and face value is the profit. ... Definition: A zero-coupon bond is a type of debt security that trades at a discount and where the only payment occurs ... Corporate Bonds | Investor.gov Floating rates are based on a bond index or other benchmark. For example, the floating rate may equal the interest rate on a certain type of Treasury bond plus 1%. One type of bond makes no interest payments until the bond matures. These are called zero-coupon bonds, because they make no coupon payments. Instead, the bond makes a single payment ...

Define zero coupon bond. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. Convexity of a Bond | Formula | Duration | Calculation The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex relationship between its price and yield, zero-coupon bonds have the highest convexity and its prices most sensitive to changes in yield. What Is a Zero-Coupon Bond? | The Motley Fool So while a traditional bond with a $10,000 face value might sell for $10,000, a zero-coupon bond with a $10,000 face value might sell for $5,000 initially. When to consider zero-coupon bonds Warrant (finance) - Wikipedia Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue. Example. Price paid for bond with warrants ; Coupon payments C; Maturity T; Required rate of return r; Face value of bond F

The Ultimate Guide to Bonds | Bonds | US News May 07, 2020 · Instead, investors buy zero-coupon bonds at a discount to par and then receive the full face value when the bond matures. You might pay $10,000 for a bond that will return $20,000 in 20 years. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Zero coupon bond definition — AccountingTools A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero coupon bond - definition of zero coupon bond by The Free Dictionary zero coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero-coupon bond Yield to Maturity Calculator (YTM Calculator) - YTM Formula C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity. To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity. For example, if you purchased a $1,000 for $900.

Zero Coupon Bond: Definition, Formula & Example - Study.com A zero coupon bond is a type of bond that doesn't make a periodic interest payment. In bond investing, the term 'coupon' refers to the interest rate repaid periodically to the bondholder. When Tom...

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Zero Coupon Bonds - UWorld Roger CPA Review Zero coupon bonds increase in value every month, but pay no regular interest payments. If you buy a series EE government savings bond, the government will not pay you regular monthly payments, but when you cash it in you will get more than you originally paid for the bond. The interest has been accruing on this bond and you will get both the ...

Zero-coupon bond - Definition, Meaning & Synonyms | Vocabulary.com a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,...

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

What does zero-coupon bond mean? - definitions A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons", hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par value.

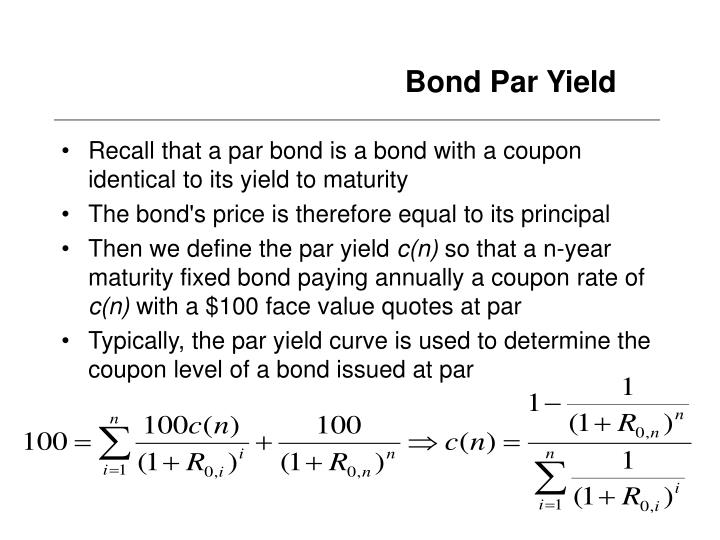

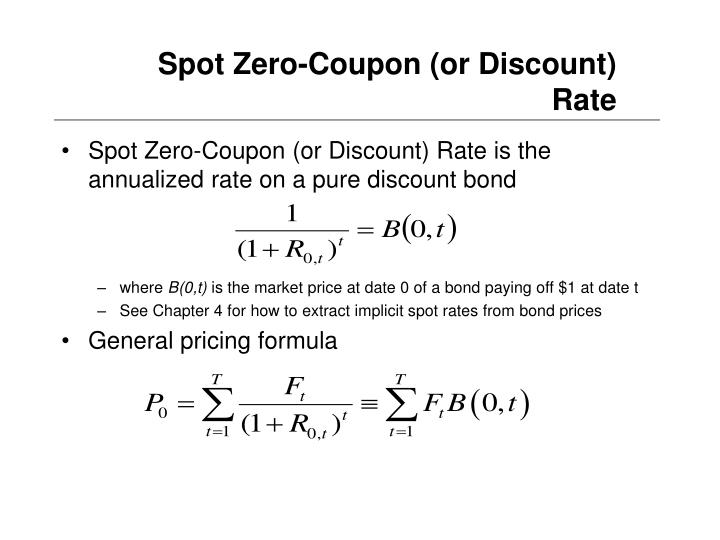

Bootstrapping Zero Curve & Forward Rates ... Oct 22, 2016 · The discounted cash flows & zero rates for later tenors will be solved for using the par bond assumption and the zero rates derived for the earlier tenors. This is illustrated in the steps that follow. 5. Let us start with the shortest tenor bond, the 0.25 year bond. Its cash flows are coupon and principal payable at maturity of 101.0075.

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial...

Zero-Coupon Bonds - Accounting Hub A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning.

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Zero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years.

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "39 define zero coupon bond"