38 coupon rate semi annual

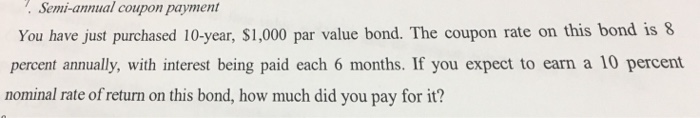

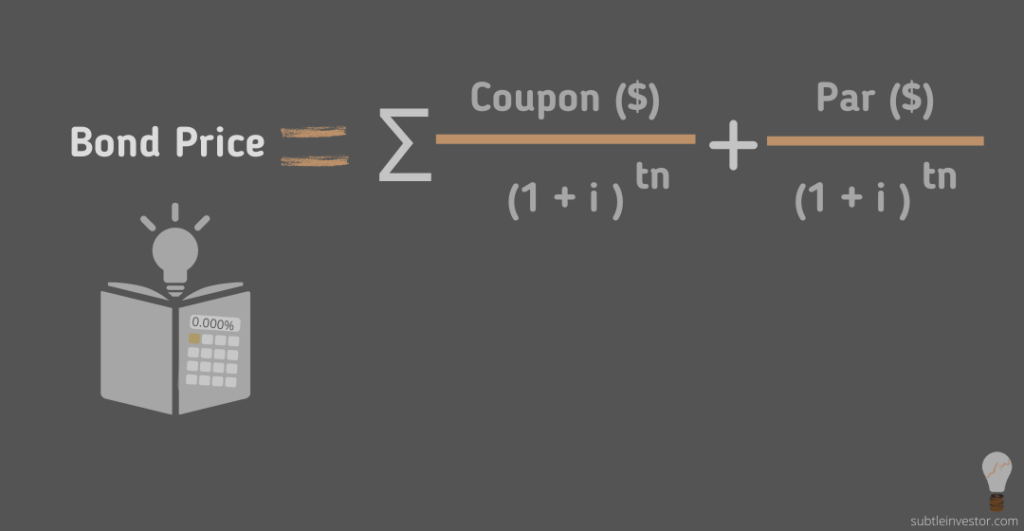

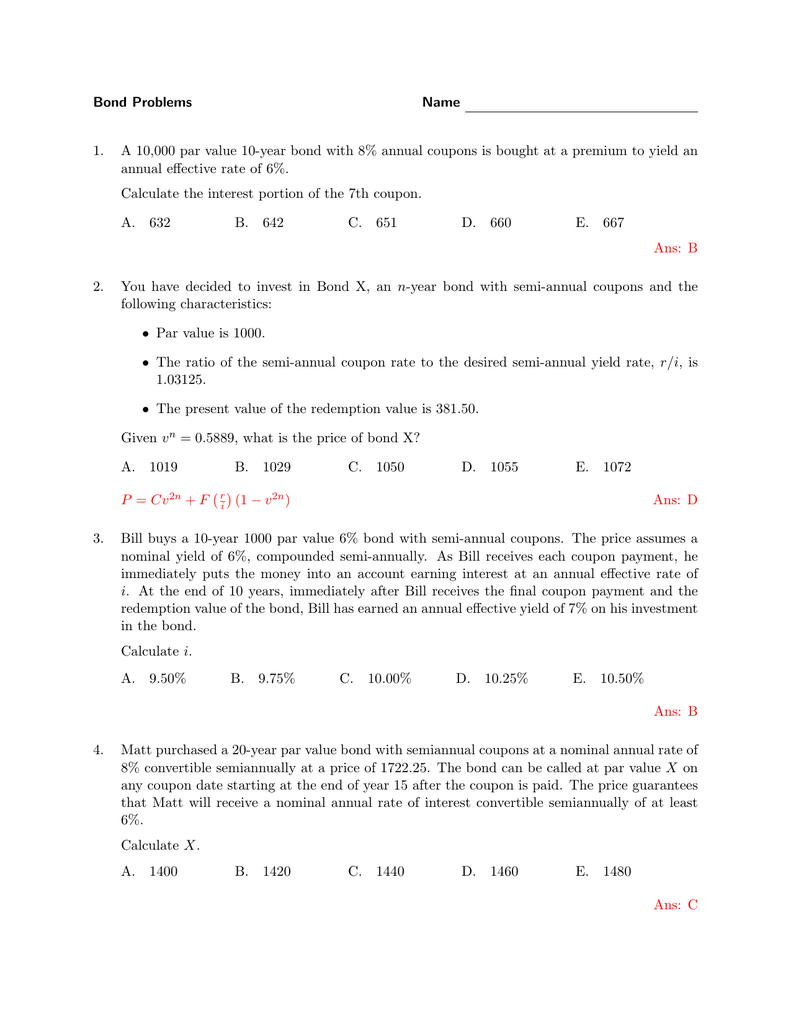

Understanding Treasury Bond Interest Rates | Bankrate The semiannual coupon payments are half that, or $6.25 per $1,000. If you have a TreasuryDirect.gov account and use it to buy and hold U.S. Treasury securities, the coupon interest payments are... Bond Valuation Overview (With Formulas and Examples) Because the coupon is 3%, our annual coupon payment is $30, and then our semi-annual payment is $15. Now, to find the present value of those semi-annual payments, which will be four total payments. Present value of coupons = 15/ (1.07)^1 + 15/ (1.07)^2 + 15/ (1.07)^3 + 15/ (1.07)^4 = $55.10 Present face value of bond = 1000/ (1.07)^4 = $748.62

Quant Bonds - On A Coupon Date - BetterSolutions.com 1) Calculate the number of coupon payments - The coupon is paid semi-annually so there will be 2 coupon payments a year, making 20 coupon payments in total 2) Calculate the value of each coupon payment. The coupon rate will be 10/2 = 5% of the bond par value, so (1000 * 0.05) = $50. 3) Calculate the semi annual interest rate.

Coupon rate semi annual

› terms › fWhat Is a Fixed-Rate Bond? - Investopedia Mar 31, 2021 · Fixed-Rate Bond: A fixed-rate bond is a bond that pays the same amount of interest for its entire term. The benefit of owning a fixed-rate bond is that investors know with certainty how much ... › knowledge-center › how-to-calculateHow to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · For instance, in the example above, an investor who bought the bond for $900 would get $10 semi-annual interest payments for five years, but would then get $1,000 at maturity -- adding another ... › apr-APR Calculator APY can sometimes be called EAPR, meaning effective annual percentage rate, or EAR, referring to the effective annual rate. The main difference between APY and APR is that the former considers yearly compounded interest while APR always means a monthly period. Thus, at the equivalent rate, APR appears lower than the APY assuming positive rates.

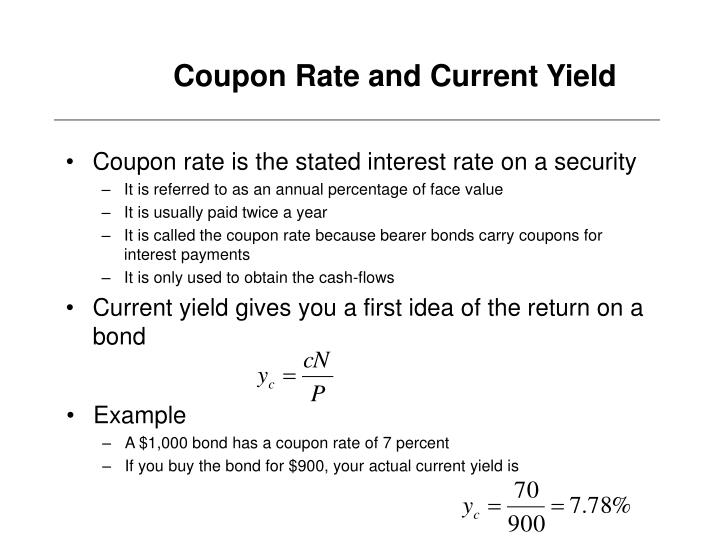

Coupon rate semi annual. Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. Coupon Rate: Definition, Formula & Calculation - Study.com XYZ Company offers $50 in annual interest per bond, to be paid semi-annually. As a potential purchaser of bonds, you desire to know the coupon rate to compare this with other investments of ... › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... How To Calculate Interest Compounded Semiannually (With ... - Indeed How to calculate interest compounded semiannually The formula for compounded interest is based on the principal, P, the nominal interest rate, i, and the number of compounding periods. The formula you would use to calculate the total interest if it is compounded is P[(1+i)^n-1]. Here are the steps to solving the compound interest formula:

Treasury bonds paying an 8% coupon rate with semiannual... get 5 - Quesba Kaplnsky Capital Geneva (8). Christoph Hoffeman of Kapinsky Capital believes the Swiss franc will appreciate versus the US dollar in the coming 3-month period. He has $100,000 to invest. The current spot rate is $0.5820/SF, the 3-month forward rate is $0.5640/SF, and he expects the spot rates to reach $0.6250/SF in three months a. › calculators › financialAPR Calculator The Advanced APR Calculator finds the effective annual percentage rate (APR) for a loan (fixed mortgage, car loan, etc.), allowing you to specify interest compounding and payment frequencies. Input loan amount, interest rate, number of payments and financing fees to find the APR for the loan. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. EOF

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... › Calculate-Annual-Interest-on-Bonds3 Ways to Calculate Annual Interest on Bonds - wikiHow Mar 29, 2019 · To calculate the annual interest, you need to know the coupon rate and the price of the bond. For example, Company QRS issues 5-year, $500,000, 10 percent bonds, with interest paid semi-annually. The market interest rate is 10 percent, so the bond is issued at par. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

Government - Semi-Annual Interest Rate Certification Semi-Annual Interest Rate Certification. In February of 1997, the Fiscal Assistant Secretary of the U.S. Department of the Treasury delegated to the Bureau of the Public Debt (now the Bureau of the Fiscal Service) the responsibility of providing interest rate certification to various agencies. The following table contains rates certified by ...

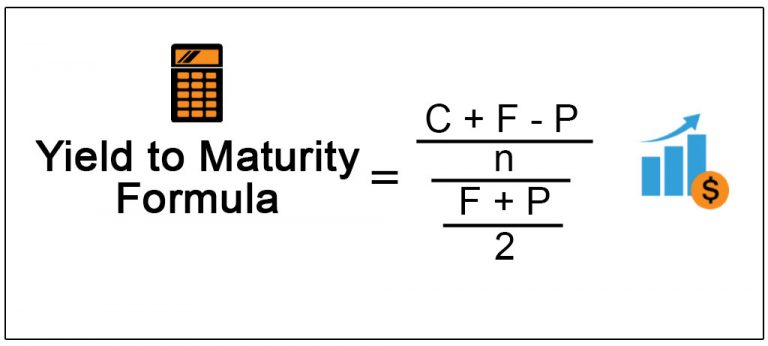

When is a bond's coupon rate and yield to maturity the same? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

› terms › eEffective Yield Definition - Investopedia Mar 23, 2020 · Effective Yield: The effective yield is the yield of a bond which has its coupons reinvested after payment has been received by the bondholder. Effective yield is the total yield an investor ...

The yield to maturity of a $1,000 bond with a 6.6% coupon... get 5 The yield to maturity of a $1,000 bond with a 6.6% coupon rate, semi-annual coupons, and two... The yield to maturity of a $1,000 bond with a 6.6% coupon rate, semi-annual coupons, and two years to maturity is 8.6% APR, compounded semi-annually. What must its price be? The price of the bond is $ (Round the nearest cent.) Jan 01 2022 | 11:47 AM ...

› apr-APR Calculator APY can sometimes be called EAPR, meaning effective annual percentage rate, or EAR, referring to the effective annual rate. The main difference between APY and APR is that the former considers yearly compounded interest while APR always means a monthly period. Thus, at the equivalent rate, APR appears lower than the APY assuming positive rates.

› knowledge-center › how-to-calculateHow to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · For instance, in the example above, an investor who bought the bond for $900 would get $10 semi-annual interest payments for five years, but would then get $1,000 at maturity -- adding another ...

› terms › fWhat Is a Fixed-Rate Bond? - Investopedia Mar 31, 2021 · Fixed-Rate Bond: A fixed-rate bond is a bond that pays the same amount of interest for its entire term. The benefit of owning a fixed-rate bond is that investors know with certainty how much ...

Post a Comment for "38 coupon rate semi annual"