38 present value of a zero coupon bond

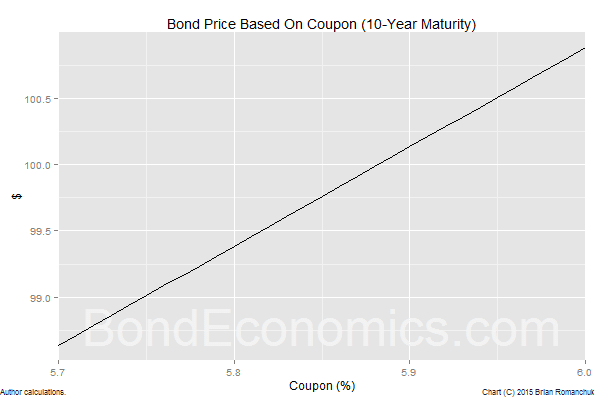

Understanding Bond Prices and Yields - Investopedia 28.6.2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods.

Zero Coupon Bond Calculator - Nerd Counter Use Zero Coupon Bond Calculator to calculate your Maturity Value in 2022. This Zero Coupon Bond Calculator can help you check your rate of change, percentage increase, percentage decrease, formula & more. ... the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield.

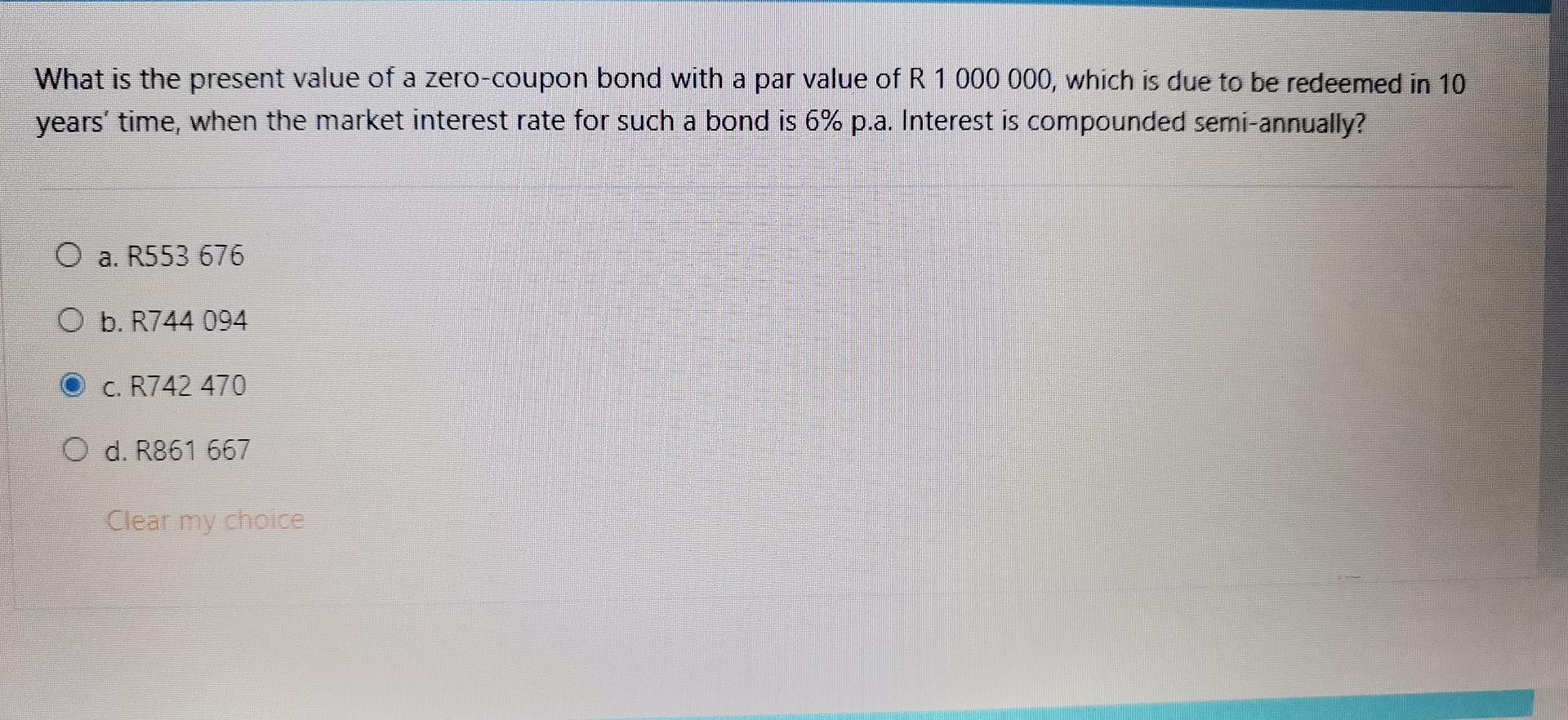

Present value of a zero coupon bond

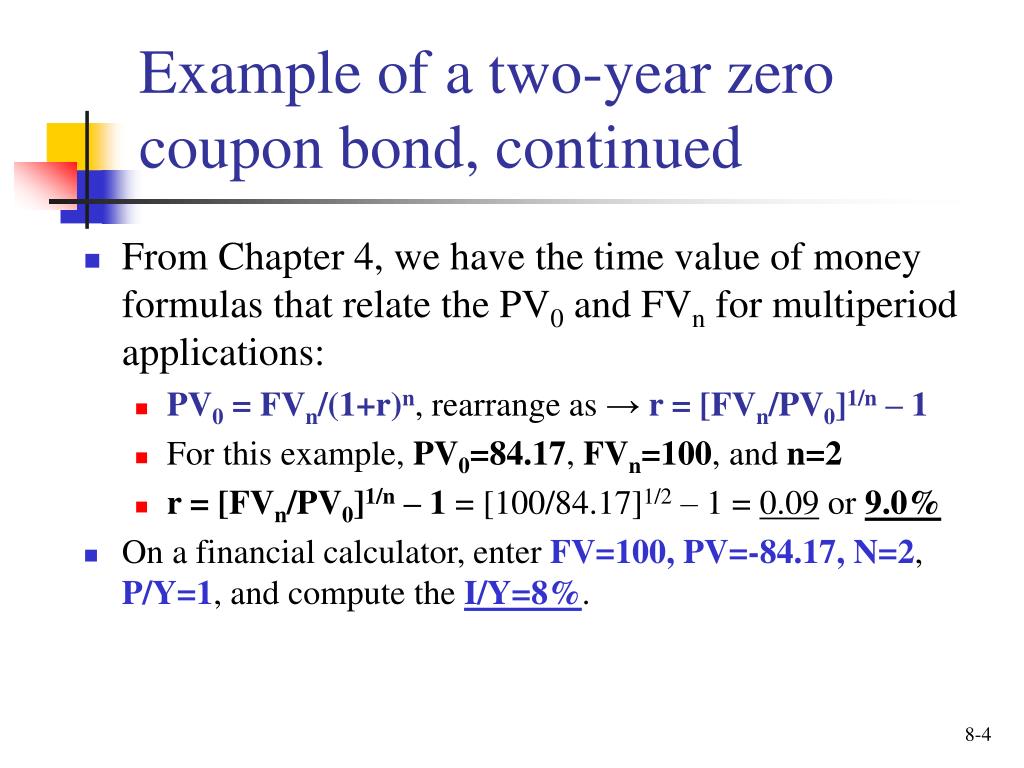

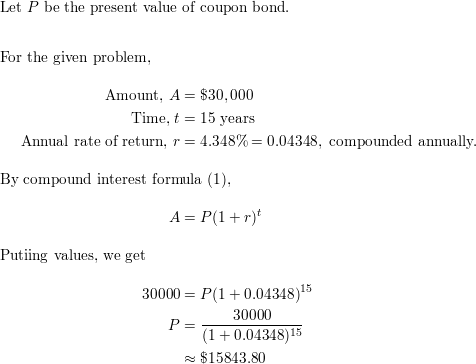

Bond valuation - Wikipedia Bond valuation. As above, the fair price of a "straight bond" (a bond with no embedded options; see Bond (finance) § Features) is usually determined by discounting its expected cash flows at the appropriate discount rate.The formula commonly applied is discussed initially. Although this present value relationship reflects the theoretical approach to determining the value of a bond, … Net present value - Wikipedia The net present value (NPV) or net present worth (NPW) applies to a series of cash flows occurring at different times. The present value of a cash flow depends on the interval of time between now and the cash flow. It also depends on the discount rate. NPV accounts for the time value of money.It provides a method for evaluating and comparing capital projects or financial … Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

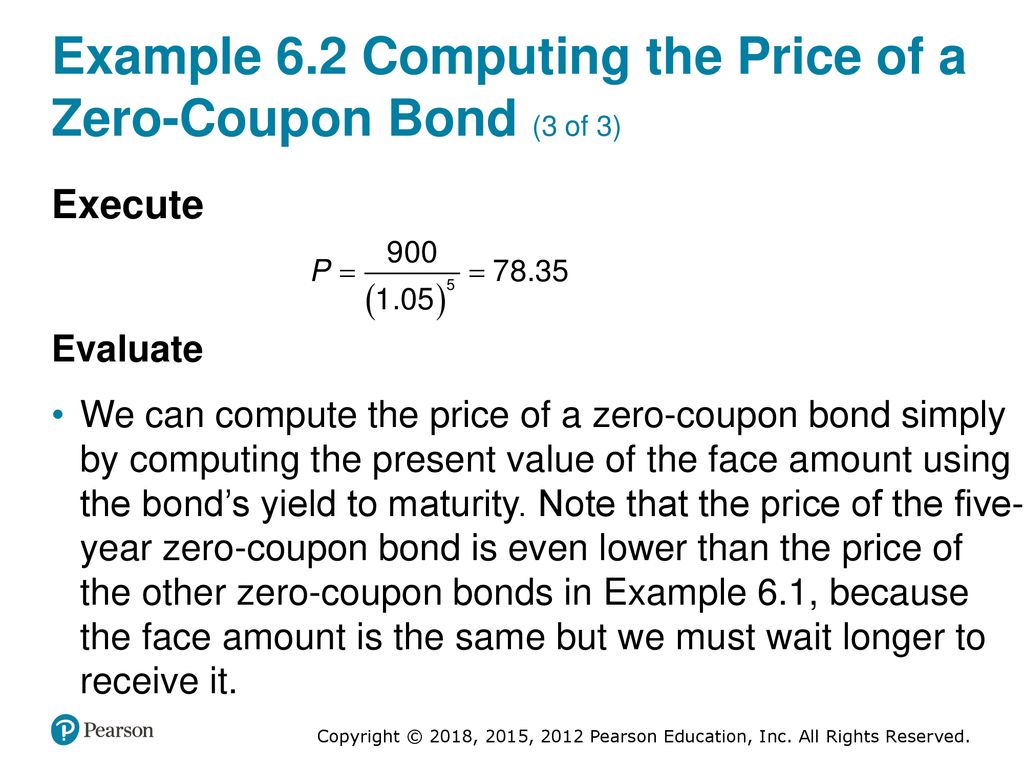

Present value of a zero coupon bond. How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow 19.4.2021 · If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). The present value of your bond is (present value of all interest payments) + … Zero-Coupon Bonds: Characteristics and Calculation Example To calculate the price of a zero-coupon bond – i.e. the present value (PV) – the first step is to find the bond’s future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. What Is Present Value in Finance, and How Is It Calculated? 13.6.2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · Duration indicates the years it takes to receive a bond’s true cost, weighing in the present value of all future coupon and principal payments. more Macaulay Duration: Definition, Formula ...

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Net present value - Wikipedia The net present value (NPV) or net present worth (NPW) applies to a series of cash flows occurring at different times. The present value of a cash flow depends on the interval of time between now and the cash flow. It also depends on the discount rate. NPV accounts for the time value of money.It provides a method for evaluating and comparing capital projects or financial … Bond valuation - Wikipedia Bond valuation. As above, the fair price of a "straight bond" (a bond with no embedded options; see Bond (finance) § Features) is usually determined by discounting its expected cash flows at the appropriate discount rate.The formula commonly applied is discussed initially. Although this present value relationship reflects the theoretical approach to determining the value of a bond, …

Post a Comment for "38 present value of a zero coupon bond"