44 what is the coupon rate of a bond

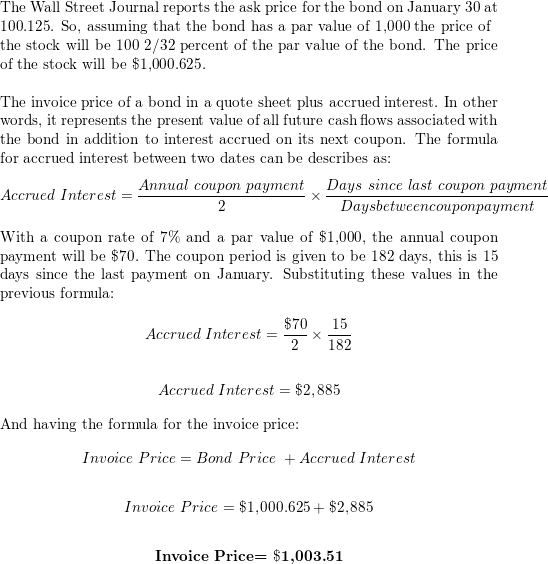

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50 . › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The annual coupon rate for IBM bond is thus $20 / $1,000 or 2%. Fixed-Rate and Market Value . While the coupon rate of a bond is fixed, the par or face value may change. No matter what price the ...

corporatefinanceinstitute.com › coupon-rateCoupon Rate - Learn How Coupon Rate Affects Bond Pricing Mar 04, 2022 · The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What is the coupon rate of a bond

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · The coupon equivalent rate (CER) is an alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. more Bond Valuation: Calculation, Definition, Formula ... en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

What is the coupon rate of a bond. en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · The coupon equivalent rate (CER) is an alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. more Bond Valuation: Calculation, Definition, Formula ...

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 what is the coupon rate of a bond"