45 what is coupon for bond

What is the difference coupon rate and yield rate? bonds market coupon rate investment retail investors yield rate. Answer. coupon bond - Meaning in English coupon bond - Meaning in English, what is the meaning of coupon bond in English dictionary, pronunciation, synonyms, usage examples and definitions of coupon bond in English and English.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The term "coupon bond" (CB) refers to the type of bond which includes coupons that are paid periodically (mostly semi-annual or annual) from the time of issuance until the maturity of the bond. These bonds come with a par value and a coupon rate, which is the bond's yield at the time of issuance.

What is coupon for bond

Bond duration - Wikipedia The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a total of $1050. Discounting to present value at 6.5%, the bond value is $937.66. The detail is the following: What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... What are coupons in treasury bills/bonds? - Quora Answer (1 of 12): They used to be actual additions to bonds printed on paper, representing the interest due at certain dates, so you could cut them from the bonds and present them for payment by the bond issuer. The nature of these financial instruments is that they generate interest payments at ...

What is coupon for bond. Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ... What is aCoupon Bond? - Realonomics A coupon bond is a type of bond. The bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed (or variable) interest rate for a specified period. that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

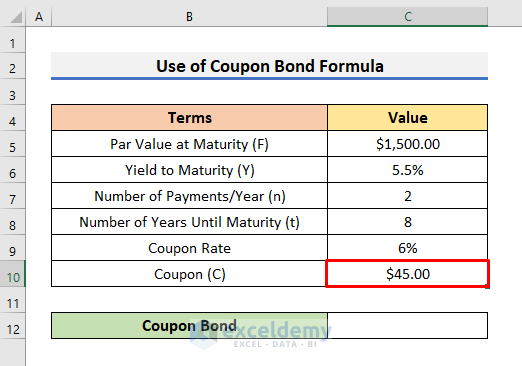

Bond Price Calculator | Formula | Chart 20.06.2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the following data … Coupon Bond Formula | Examples with Excel Template - EDUCBA The term "coupon" refers to the periodic interest payment received by bondholders and bonds that make such payments are known as coupon bonds. Typically, the coupon is expressed as a percentage of the par value of the bond. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve … What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Coupon Bond - Definition, Terminologies, Why Invest? - WallStreetMojo A coupon bond is a good way of increasing your income over a period of time. Coupon bonds are subjected to taxation in the US. Hence they can be held in a tax-deferred retirement account in order to save investors on paying taxes on the future income. Zero-Coupon Bond Definition - Investopedia Payment of interest, or coupons, is the key differentiator between a zero-coupon and regular bond. Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

coupon payment on bond : r/interactivebrokers Coupon Payment: XXX@BONDDESK. XXX 0.95 04/01/24 announced a coupon payment, effective 20220929. The declared rate on the coupon payment will be USD 0.00475. I just received this message.

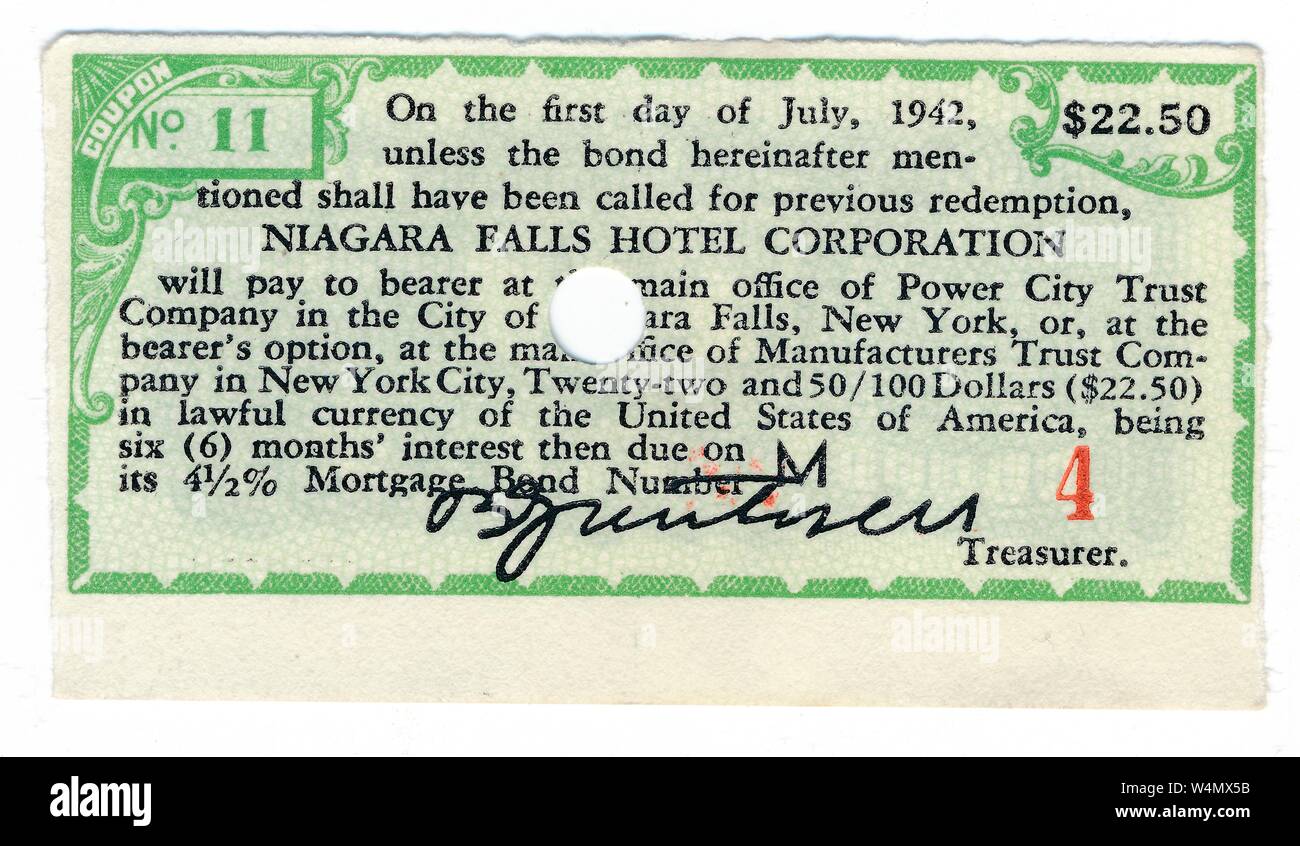

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon … The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than …

What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. These instalments are called ...

Bond Formula | How to Calculate a Bond | Examples with Excel … Step 1: Initially, determine the par value of the bond and it is denoted by F. Step 2: Next, determine the rate at which coupon payments will be paid and using that calculate the periodic coupon payments. It is the product of the par value of the bond and coupon rate. It is denoted by C and mathematically represented as shown below.

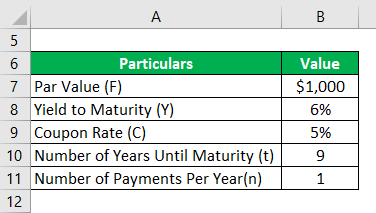

Investment Banking, Financial Modeling & Excel Blog Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

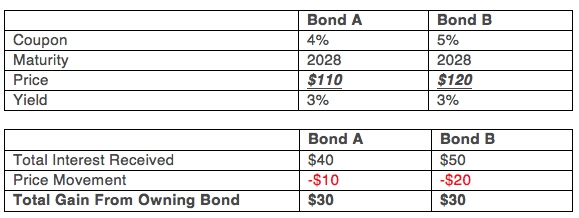

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Typically, bondholders make a profit on their investment through regular interest payments, made annually or semi-annually, known as "coupon payments." But as the name suggests, zero-coupon bonds...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Bond Discount - Investopedia 29.05.2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase price of the bond, its nominal return over its duration & its yield to maturity. Entering Years: For longer duration bonds enter the number of years to maturity.

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a ...

What are coupons in treasury bills/bonds? - Quora Answer (1 of 12): They used to be actual additions to bonds printed on paper, representing the interest due at certain dates, so you could cut them from the bonds and present them for payment by the bond issuer. The nature of these financial instruments is that they generate interest payments at ...

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Bond duration - Wikipedia The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a total of $1050. Discounting to present value at 6.5%, the bond value is $937.66. The detail is the following:

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "45 what is coupon for bond"