45 definition of coupon rate

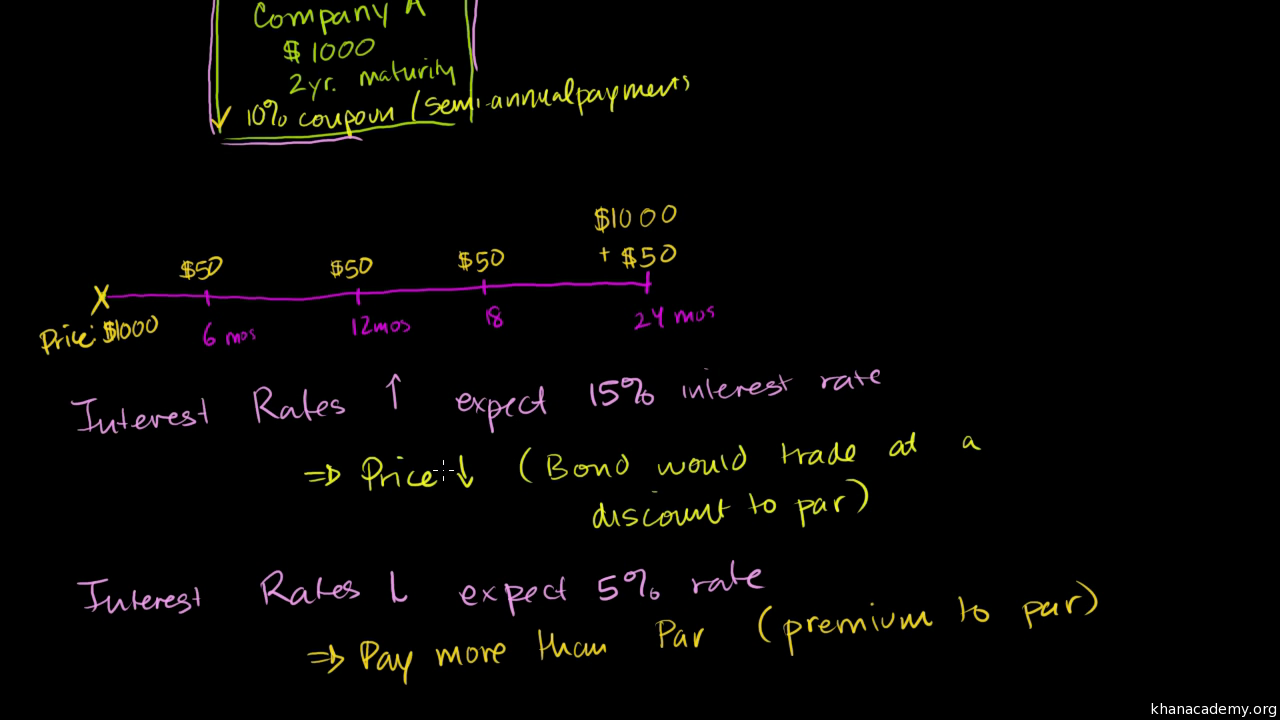

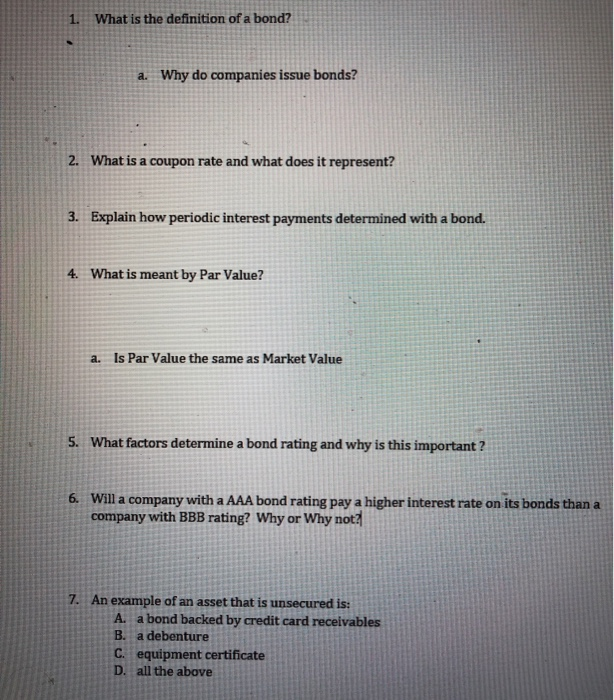

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. Coupon Rate Formula | Step by Step Calculation (with Examples) The term " coupon rate " refers to the rate of interest paid to the bondholders by the bond issuers. In other words, it is the stated rate of interest paid on fixed income securities, primarily applicable to bonds.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Definition of coupon rate

What Are Corrosion Coupons? - Chardon Labs Corrosion coupons are pre-weighed and measured metal strips which are mounted in a special pipe system called a coupon rack . They are used to estimate the rate of metal corrosion by comparing the initial weight with the weight following 60, 90 or 120 days of exposure to the water in the system. Corrosion coupons are available in a wide variety ... Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Coupon Rate vs Interest Rate. The main difference between Coupon Rate and Interest Rate is that the coupon ... Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy.

Definition of coupon rate. Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. Coupon (finance) - Wikipedia Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon Frequency Definition | Law Insider definition. Coupon Frequency means how regularly an issuer pays the coupon to holder. Bonds pay interest monthly, quarterly, semi - annually or annually. (d) Maturity date is a date in the future on which the investor 's principal will be repaid. From that date, the security ceases to exist.

COUPON | meaning, definition in Cambridge English Dictionary coupon definition: 1. a piece of paper that can be used to get something without paying for it, or at a reduced price…. Learn more. Coupon rate financial definition of Coupon rate - TheFreeDictionary.com Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. Coupon Definition & Meaning - Merriam-Webster 1 : a statement of due interest to be cut from a bearer bond when payable and presented for payment also : the interest rate of a coupon. 2 : a small piece of paper that allows one to get a service or product for free or at a lower price: such as. Coupon - Wikipedia In marketing, a coupon is a ticket or document that can be redeemed for a financial discount or rebate when purchasing a product.. Customarily, coupons are issued by manufacturers of consumer packaged goods or by retailers, to be used in retail stores as a part of sales promotions.They are often widely distributed through mail, coupon envelopes, magazines, newspapers, the Internet (social ...

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon Rate - Morningstar, Inc. Coupon Rate. The annual interest rate of a debt/bond security that the issuer promises to pay to the holder until maturity. Discount Rate - Definition, Types and Examples, Issues In corporate finance, a discount rate is the rate of return used to discount future cash flows back to their present value. This rate is often a company's Weighted Average Cost of Capital (WACC), required rate of return, or the hurdle rate that investors expect to earn relative to the risk of the investment. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

What is a Coupon? - Definition | Meaning | Example - My Accounting Course Coupon rates are set by the companies or governments that issue the bonds and can vary immensely depending on the duration of the term of the bond and/or the stability of the issuing entity. For example, a bond that has a 30-year term may have a higher rate than a 1-year note, in order to compensate the holder for having to wait longer for the ...

What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer promises to make periodic payments to the bondholder, based on the principal amount of the bond, ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is the...

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ...

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy.

Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Coupon Rate vs Interest Rate. The main difference between Coupon Rate and Interest Rate is that the coupon ...

What Are Corrosion Coupons? - Chardon Labs Corrosion coupons are pre-weighed and measured metal strips which are mounted in a special pipe system called a coupon rack . They are used to estimate the rate of metal corrosion by comparing the initial weight with the weight following 60, 90 or 120 days of exposure to the water in the system. Corrosion coupons are available in a wide variety ...

/interestrates-28359fec035e44b1a1e52b3a026d3baf.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "45 definition of coupon rate"