39 consider a zero coupon bond with 20 years to maturity

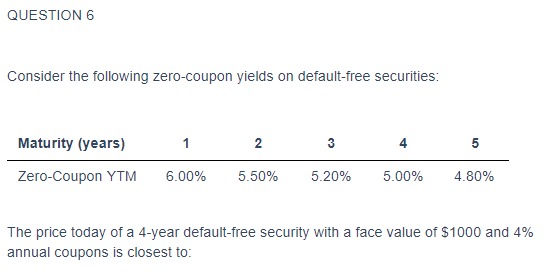

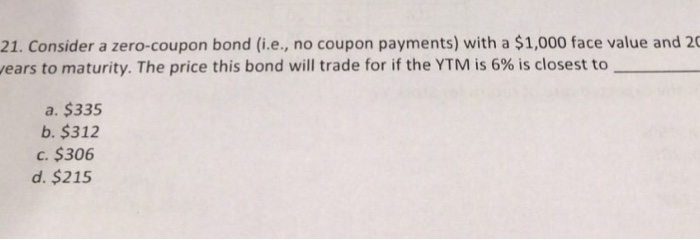

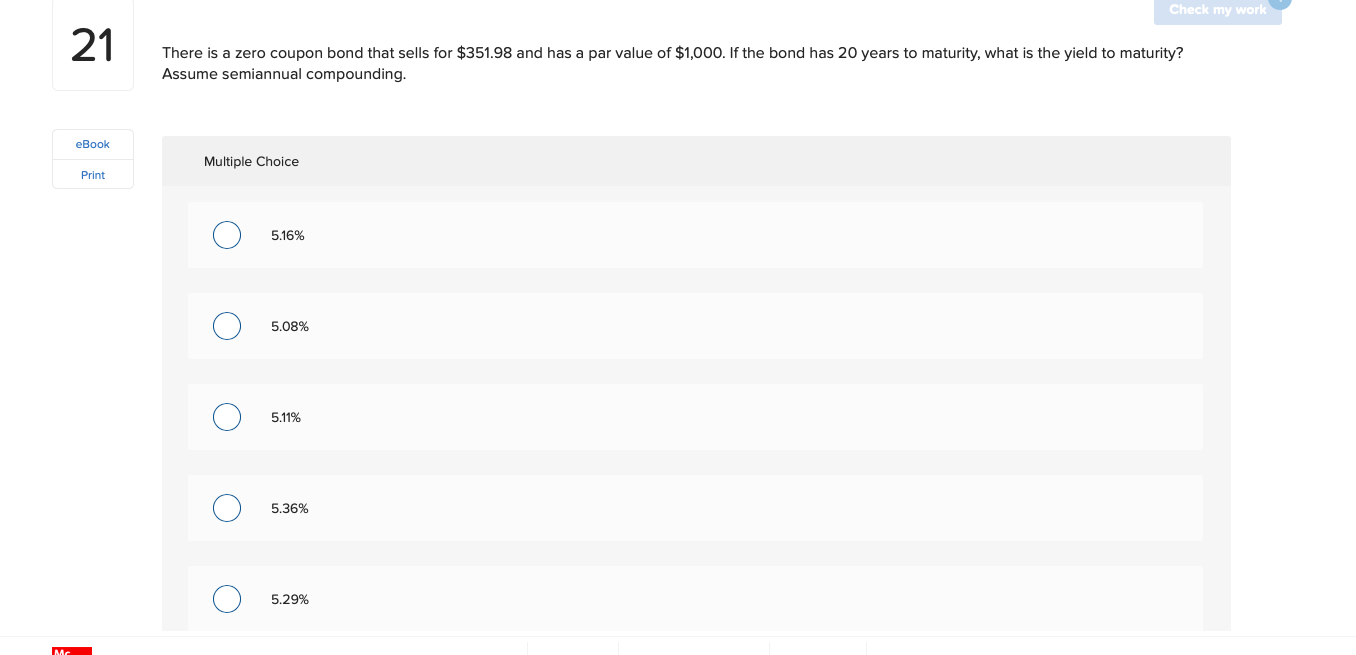

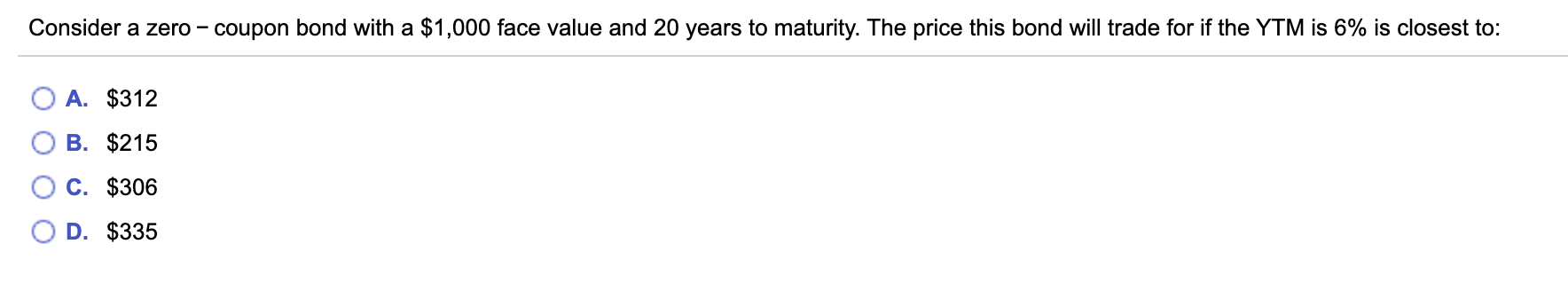

Question 21 consider a zero coupon bond with 20 years - Course Hero QUESTION 21 Consider a zero-coupon bond with 20 years to maturity. The price this bond will trade at ifthe YTM is 6% is closest to: $215 $312 $335 $306 Bond value 1000 1+0.06^20 Bond value 1000 3.207135472 Bond value $ 312 QUESTION 22 An investor purchases a 30-year, zero-coupon bond with a face value of $1000 and a yield to maturity of 6.5%. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

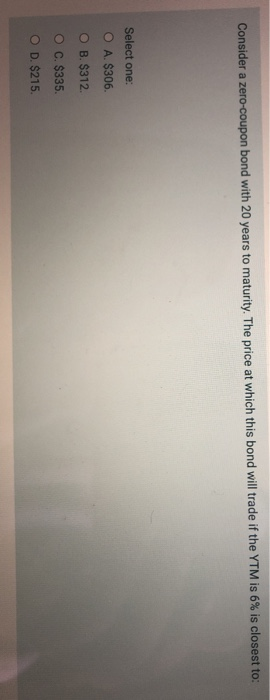

Consider a zero coupon bond with 20 years to maturity Consider a zero- coupon bond with 20 years to maturity . The price will this bond trade if the YTM is 6 % is closest to ______________ _ _. Hint : Assume par value is $ 1000 , annual compounding . A . $ 215 B. $ 312 C. $ 335 D. $ 306 14 . Consider a zero- coupon bond with a $ 1000 face value and 10 years left until maturity .

Consider a zero coupon bond with 20 years to maturity

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Consider a zero coupon bond with 20 years to maturity Consider a zero coupon bond with 20 years to maturity School University of Winnipeg Course Title BUSINESS Finance Uploaded By Basan_22 Pages 34 Ratings 98% (131) This preview shows page 14 - 18 out of 34 pages. View full document See Page 1 16) Consider a zero coupon bond with 20 years to maturity. Answered: Consider a zero-coupon bond with a face… | bartleby Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its current fair value at t=0. (only one possible answer) $55.00 $ 57.09 $58.09 $60.00 $100.00 b. Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its DV01 at t=0. (only one possible answer)

Consider a zero coupon bond with 20 years to maturity. Answered: Consider a zero-coupon bond with a… | bartleby Transcribed Image Text: Consider a zero-coupon bond with a $1,000 face value and 10 years left until maturity. If the YTM of this bond is 11.2%, then the price of this bond is closest to: O A. $415.08 O B. $346.00 O C. $1,000.00 O D. $484.26. 6.2.2 Flashcards | Quizlet C) The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment. D) When prices are quoted in the bond market, they are conventionally quoted in increments of $1,000. D Consider a zero-coupon bond with $100 face value and 15 years to maturity. Consider a zero coupon bond with 20 years to maturity 15) Consider a zero-coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to 5% is closest to: A) $118. B) -$53. C) $53. D) $673. Answer: Explanation: Following the prior logic, let's first price the zero-coupon bond at 7%. P = $ 1,000 (1 + 7%) 20 = $ 258.42 Now at ... Investments Final Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Bond Price Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today., YTM- Zero Coupon Bond A zero coupon bond has a par value of $1,000, a market price of $150 and 20 years to maturity. Calculate ...

25 Consider a zero coupon bond with 20 years to maturity and a face ... 25) Consider a zero coupon bond with 20 years to maturity and a face value of $1000. The price will this bond trade at if the YTM is 6% is closest to: A) $215 B) $312 C) $335 D) $306 Answer: Explanation: B)FV= 1000 I= 6 PMT= 0 N=20 ComputePV = 311.80 or, PV = FV (1+i) = 1000 20(1+.06) = 311.80B N. ECO389 HW 2 - Solutions Use the information for ... Solved Consider a zero-coupon bond with 20 years to - Chegg Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306. OB. $312 O c. $335. O D. $215. Question: Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306. Zero-Coupon Bond Definition - Investopedia Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates to 6% interest per year. The greater the length of time until the bond matures, the less the investor pays for it, and... What is the difference between a zero-coupon bond and a regular bond? A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield curve, long-term bonds have higher ...

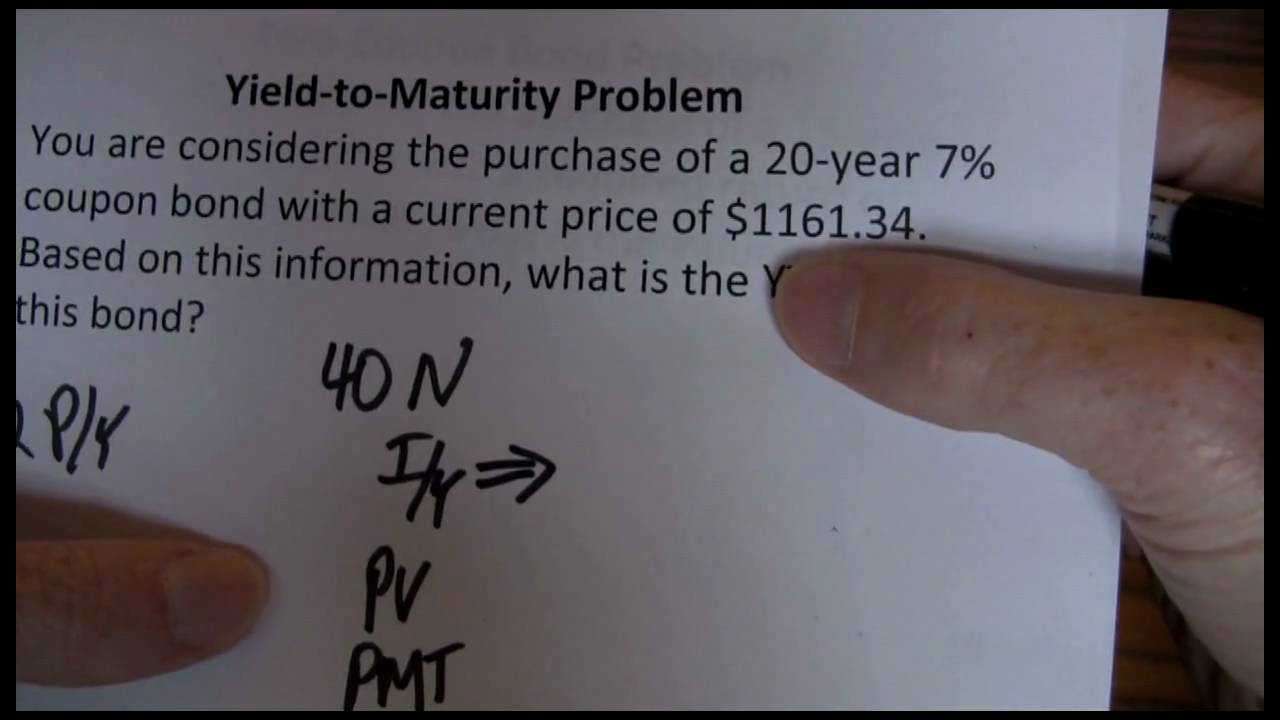

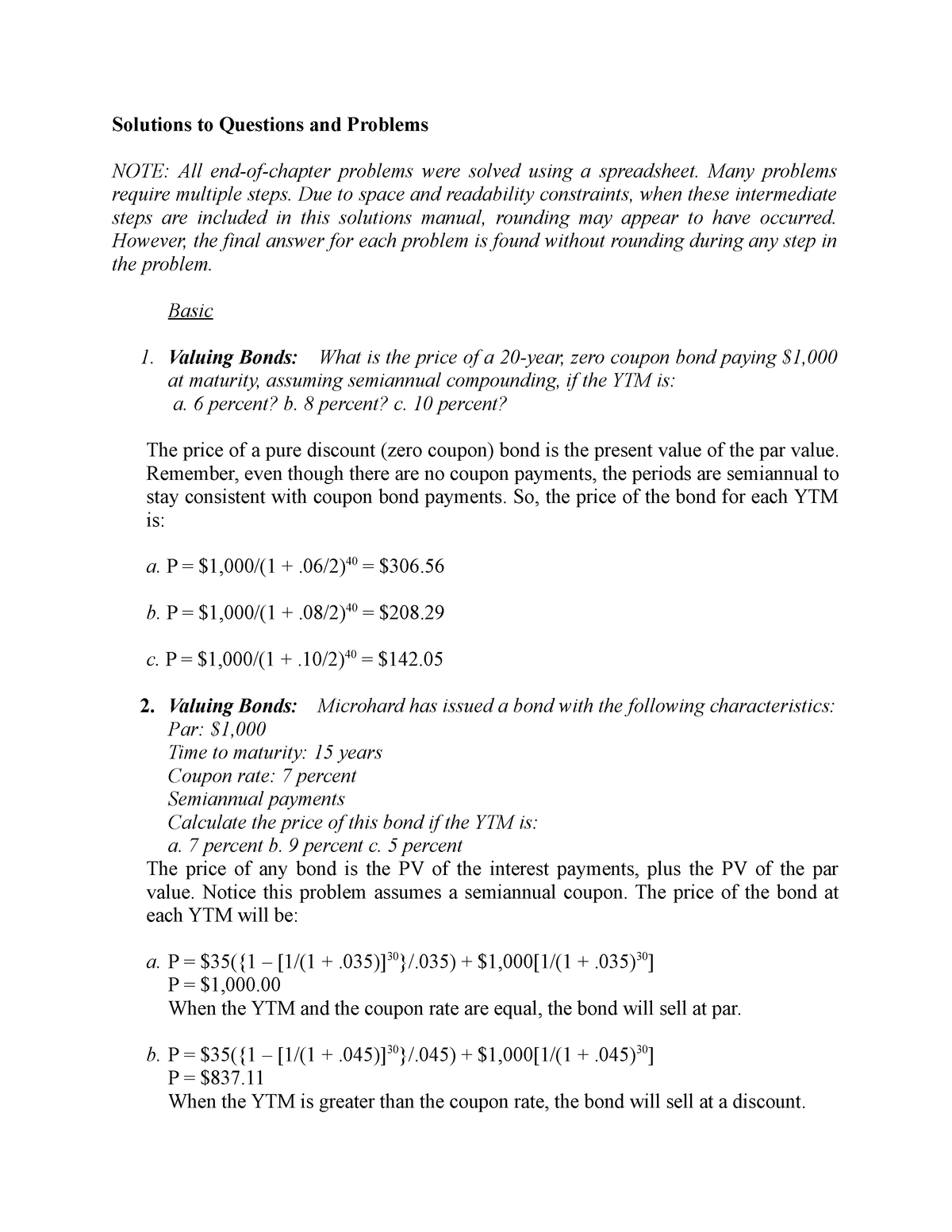

Solved Consider a zero coupon bond with 20 years to | Chegg.com Expert Answer Given the following information, Years to maturity = n = 20 Assume Face value = FV = 1000 When yield to maturity = YTM = 7% = … View the full answer Transcribed image text: Consider a zero coupon bond with 20 years to maturity. What will happen to the price of the bond if its yield to maturity decreases from 7% to 5%? A. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Answered: Consider a zero-coupon bond with a… | bartleby Consider a zero-coupon bond with a $1,000 face value and 10 years to maturity. The price this bond will trade if the Yield To Maturity is 7.1% is closest to: A) $604.35 B) $805.8 C) $705.07 D) $503.62. Question. Consider a zero-coupon bond with a $1,000 face value and 10 years to maturity. The price this bond will trade if the Yield To Maturity ...

Principles of Investments- Chapter 10 Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000. ... a. $458.11. Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity Yield to Maturity A 1 6.00% B 2 7.50% C 3 8.00% D 4 8.50% E 5 10.25% The expected 1-year interest rate in the third year should be _____. ... Consider the expectations ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The responsiveness of bond prices to interest rate changes increases with the term to maturity and decreases with interest payments. Thus, the most responsive bond has a long time to maturity...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

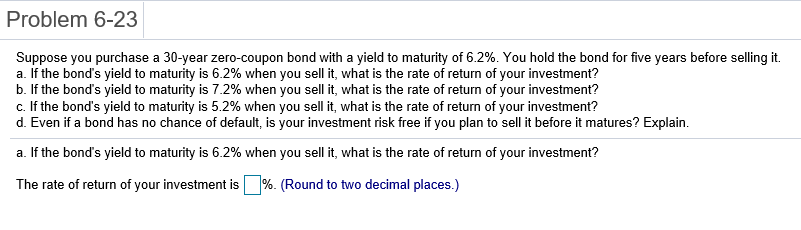

Solved Consider a zero coupon bond with 20 years to maturity - Chegg 1) The current yield is: 2). The yield to maturity is: Please show work. Question: Consider a zero coupon bond with 20 years to maturity and $25,000 face value if the current market price is $15,000. (Use semiannual compounding in your calculations). 1) The current yield is: 2). The yield to maturity is: Please show work.

Consider a $1,000-par-value 20-year zero-coupon bond issued at a yield ... answered • expert verified Consider a $1,000-par-value 20-year zero-coupon bond issued at a yield to maturity of 10%. If you buy that bond when it is issued and continue to hold the bond as yields decline to 9%, the imputed interest income for the first year of that bond is star2371 is waiting for your help. Add your answer and earn points.

Answered: Consider a bond with a zero percent… | bartleby Business Finance Q&A Library Consider a bond with a zero percent coupon rate with 20 years to maturity and a face value of $1,000. What is the price of the bond if the yield-to-maturity is 6%?: $215 $306 $312 $335. Consider a bond with a zero percent coupon rate with 20 years to maturity and a face value of $1,000.

When is a bond's coupon rate and yield to maturity the same? - Investopedia A bond with a $1,000 par value and coupon rate of 5% pays $50 in interest each year until maturity. Suppose you purchase an IBM Corp . bond with a $1,000 face value, and it is issued with semi ...

Solved Consider a zero coupon bond with 20 years to - Chegg This problem has been solved! See the answer Consider a zero coupon bond with 20 years to maturity. The percentage change in the price of the bond if its yield to maturity decreases from 7% to 5% is closest to Expert Answer 100% (3 ratings) Assuming face value to be $1,000 Price at 7% = FV / (1 + r)n Price at 7% … View the full answer

Solved Consider a zero coupon bond with 20 years to - Chegg See the answer Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is closest to: Expert Answer 100% (1 rating) Price of a Zero coupon bond = Face value * ( 1 + r)-n Fa … View the full answer Previous question Next question

Answered: Consider a zero-coupon bond with a face… | bartleby Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its current fair value at t=0. (only one possible answer) $55.00 $ 57.09 $58.09 $60.00 $100.00 b. Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its DV01 at t=0. (only one possible answer)

Consider a zero coupon bond with 20 years to maturity Consider a zero coupon bond with 20 years to maturity School University of Winnipeg Course Title BUSINESS Finance Uploaded By Basan_22 Pages 34 Ratings 98% (131) This preview shows page 14 - 18 out of 34 pages. View full document See Page 1 16) Consider a zero coupon bond with 20 years to maturity.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Post a Comment for "39 consider a zero coupon bond with 20 years to maturity"