38 zero coupon bond journal entry

Journal Entries of Zero Coupon Bonds - YouTube Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy g... Accounting for Zero-Coupon Bonds - GitHub Pages Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Solved Assume a firm issues a zero-coupon bond on 1/1/2021. | Chegg.com ii. Make the journal entry to issue the bonds on 1/1/2021 iii. Make the entry to record interest on 12/31/2021 and 12/31/2022. iv. Make the entry to retire the principle of the bonds on 12/31/2040v. For every entry, record the effects

Zero coupon bond journal entry

Zero Coupon Bond Issued At Discount Amortization And Accounting Journal ... accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cash flow diagram, face (maturity) value, no... Answered: On January 1, 2021, Darnell Window and… | bartleby ASK AN EXPERT. Business Accounting Q&A Library On January 1, 2021, Darnell Window and Pane issued $18 million of 10 year, zero-coupon bonds for $5,795,518.Required:1. Prepare the journal entry to record the bond issue.2. Determine the effective rate of interest.3. Prepare the journal entry to record annual interest expense at December 31, 2021.4. Journal Entry for Bonds - Accounting Hub Therefore, the journal entry for semiannual interest payment is as follow: This interest payment will start from June 30, 2020, until December 31, 2039. At the maturity date, which is on December 31, 2039, the bonds will need to retire. Thus, ABC Co needs to repay back the principal of the bonds to the bondholders.

Zero coupon bond journal entry. Answered: Assume a firm issues a zero-coupon bond… | bartleby Assume a firm issues a zero-coupon bond on 1/1/2021. The face value is $5,000,000, and the effective rate is 4.1%, compounded annually over the 20 years of the bond i. Make the amortization table ii. Make the journal entry to issue the bonds on 1/1/2021 iii. Make the entry to record interest on 12/31/2021 and 12/31/2022 iv. Journal Entry for Zero Coupon Bonds | Accounting Education Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ 3471. It means Mr. David bought it at $ 16529 at 10% per year his earning. At the end of second year, company has to pay only face value of $ 20000. Zero Interest Bonds | Formula | Example | Journal Entry - Accountinguide Please prepare the journal entry during issuing and the annual interest expense. As the company issue bonds at zero interest rate, we need to calculate the selling price first. Selling price = $ 100/ (1+6%)^5 = $ 74.72 Company needs to sell bonds at $ 74.72 per bond. So the company will receive the cash of $ 74,270 for selling 1,000 bonds. Accounting Deep Discount Bonds - I GAAP & IFRS - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond.

Convertible zero-coupon bonds - journal entry Code: 3M originally sold $639 million in aggregate face amount of these "Convertible Notes" (zero-coupon bonds with maturity 30 years) on November 15, 2002, which are convertible into shares of 3M common stock. The gross proceeds from the offering, to be used for general corporate purposes, were $550 million ($540 million net of issuance costs). Accounting for Zero-Coupon Bonds - Lardbucket.org The entry shown in Figure 14.8 "January 1, Year One—Zero-Coupon Bond Issued at Effective Annual Interest Rate of 6 Percent" can also be recorded in a slightly different manner. Under this alternative, the liability is entered into the records at its face value of $20,000 along with a separate discount of $2,200. Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond. Zero Coupon Bonds's Journal Entries | Svtuition August 24, 2012 Journal Entries of Zero Coupon Bonds Watch on Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy getting the zero coupon bonds at discount.

14.3: Accounting for Zero-Coupon Bonds - Business LibreTexts Figure 14.10 December 31, Year Two—Interest on Zero-Coupon Bond at 6 Percent Rate. Note that the bond payable balance has now been raised to $20,000 as of the date of payment ($17,800 + $1,068 + $1,132). In addition, interest expense of $2,200 ($1,068 + $1,132) has been recognized over the two years. Recording Entries for Bonds | Financial Accounting - Course Hero ProfessorBDoug's Bond Discount Journal Entry For our example assume Jan 1 Carr issues $100,000, 12% 3-year bonds for a price of 95 1/2 or 95.50% with interest to be paid semi-annually on June 30 and December 30 for cash. We know this is a discount because the price is less than 100%. The entry to record the issue of the bond on January 1 would be: Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Bond Retirement | Boundless Accounting | | Course Hero The journal entry to record the retirement of a bond: Debit Bonds Payable & Credit Cash. Learning Objectives ... Bonds can be classified to coupon bonds and zero coupon bonds. For coupon bonds, the bond issuer is supposed to pay both the par value of the bond and the last coupon payment at maturity. In case of a zero coupon bond, only the ...

Solved On January 1, 2021, Darnell Window and Pane issued - Chegg On January 1, 2021, Darnell Window and Pane issued $18 million of 10-year, zero-coupon bonds for $5,795,518. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 2. Determine the effective rate of interest. 1. & 3. to 5. Prepare the necessary journal entries

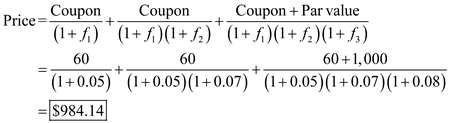

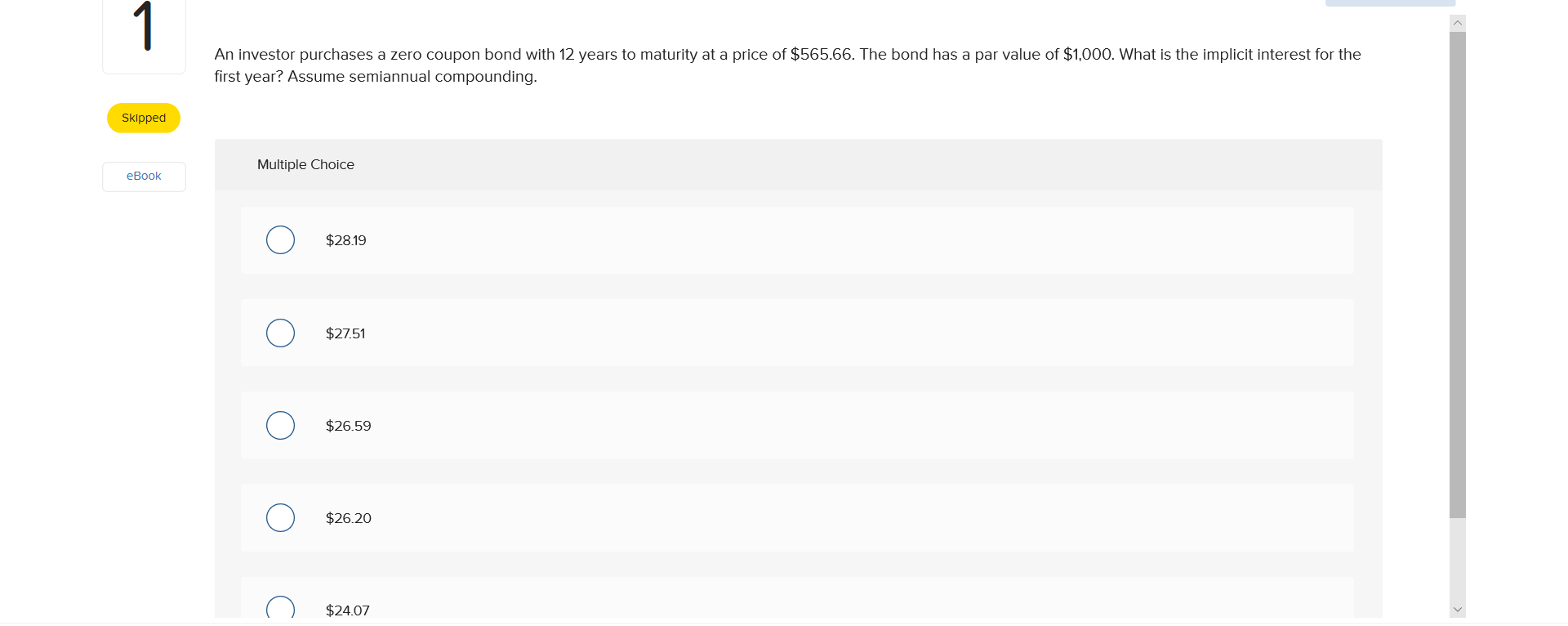

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Problem 14-9 Zero-coupon bonds [LO14-2] On January 1, 2018, Darnell ... TAFF On January 1, 2021, Darnell Window and Pane issued $19.8 million of 10-year zero coupon bonds for $7633.757. (EY of $1. PV of $1 EVA of $1. PVA OLS1, EVAD of S1 and PVAD of S1) (Use appropriate foctor(s) from the tables provided.) Required: 2. Determine the effective rate of interest 1. & 3. to 5. Prepare the necessary journal entries.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Accounting for Issuance of Bonds (Example and Journal Entry) Suppose ABC company issues a bond at a par value of $ 100,000 and a coupon rate of 5% with 5 years maturity. The market interest rate is also 5%. Let us calculate the PV of bond principal payment and interest component first. PV of bond = $ 100,000 × (0.78355) = $ 78,355. PV Factor 5%, 5 years = 0.78355. Coupon/Interest = $ 100,000 × 5% ...

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Zero-Coupon Bond - an overview | ScienceDirect Topics Moorad Choudhry, in The Bond & Money Markets, 2001. 14.5.2 Bond interest payment. Corporate bonds pay a fixed or floating-rate coupon. Floating-rate bonds were reviewed in Chapter 5. Zero-coupon bonds are also popular in the corporate market, indeed corporate zero-coupon bonds differ from zero-coupon bonds in government markets in that they are actually issued by the borrower, rather than ...

Zero Coupon Bond Questions and Answers | Study.com Your company wants to raise $10 million by issuing 20-year zero-coupon bonds. If the yield to maturity on the bonds will be 6% (annually compounded APR), what total principal amount of bonds must...

Deferred Coupon Bond | Formula | Journal Entry - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. Please calculate the bond price that company needs to sell to attract investors.

Journal Entry for Bonds - Accounting Hub Therefore, the journal entry for semiannual interest payment is as follow: This interest payment will start from June 30, 2020, until December 31, 2039. At the maturity date, which is on December 31, 2039, the bonds will need to retire. Thus, ABC Co needs to repay back the principal of the bonds to the bondholders.

Answered: On January 1, 2021, Darnell Window and… | bartleby ASK AN EXPERT. Business Accounting Q&A Library On January 1, 2021, Darnell Window and Pane issued $18 million of 10 year, zero-coupon bonds for $5,795,518.Required:1. Prepare the journal entry to record the bond issue.2. Determine the effective rate of interest.3. Prepare the journal entry to record annual interest expense at December 31, 2021.4.

Zero Coupon Bond Issued At Discount Amortization And Accounting Journal ... accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cash flow diagram, face (maturity) value, no...

Post a Comment for "38 zero coupon bond journal entry"