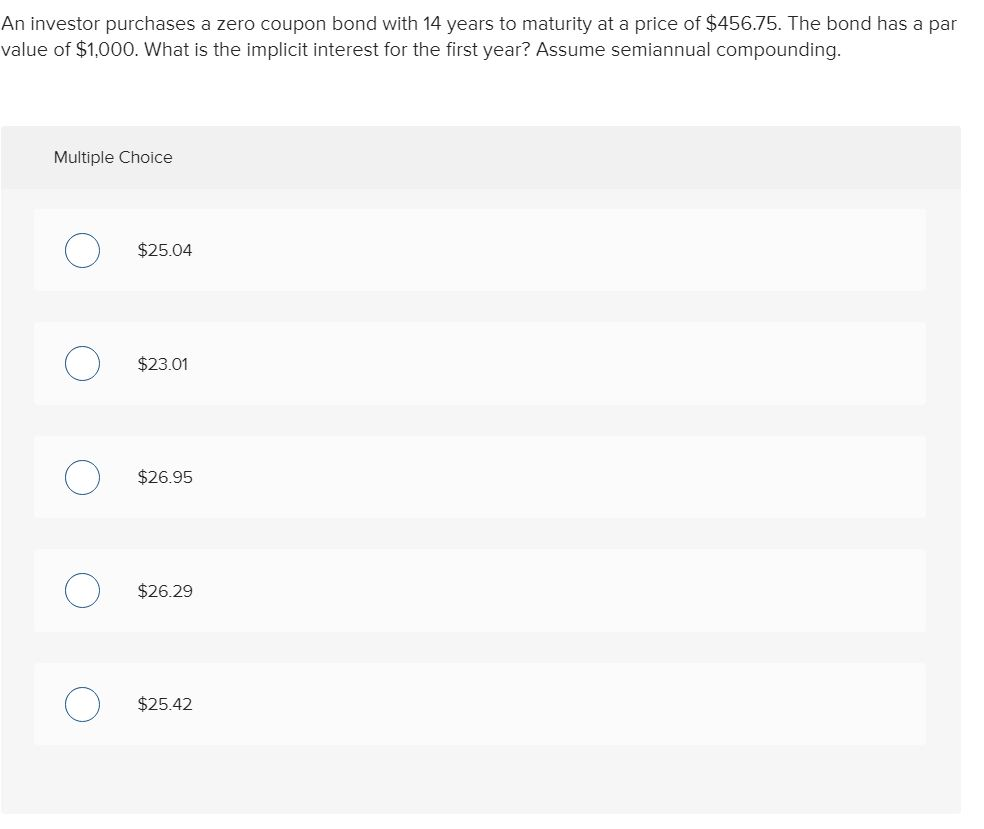

41 advantage of zero coupon bonds

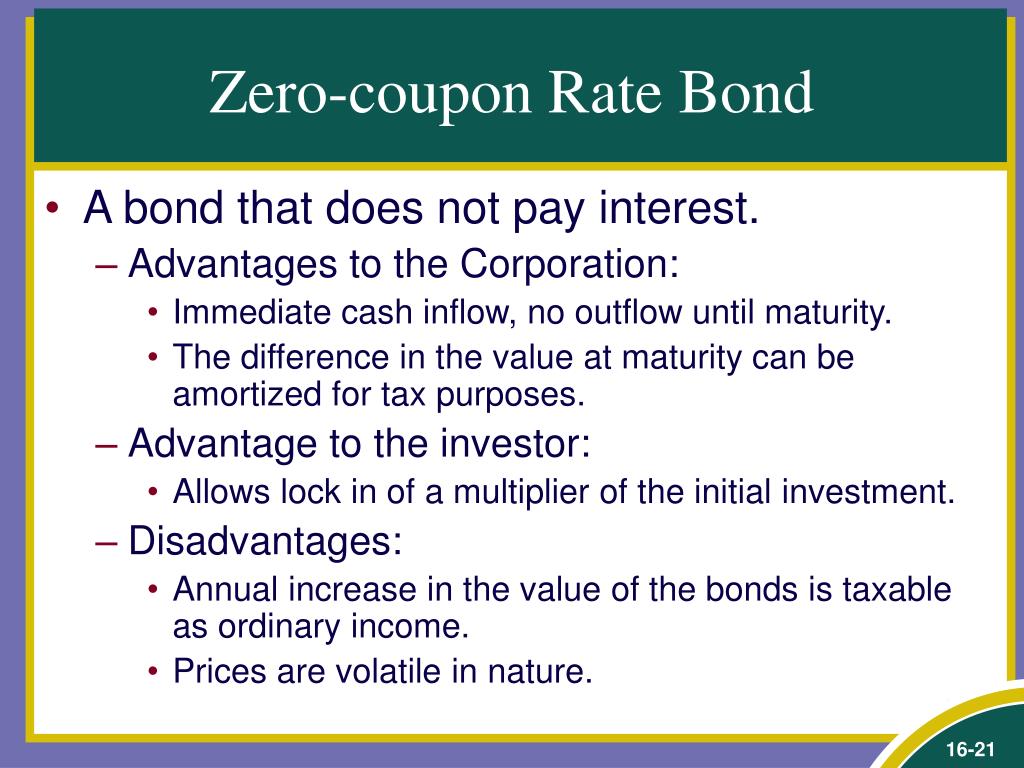

What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. Financial Management Chapter 7 Flashcards - Quizlet Which of the following statements is CORRECT? a. If market interest rates remain at 10%, Bond Z's price will be 10% higher one year from today. b. If the bonds' market interest rate remains at 10%, Bond Z's price will be lower one year from now than it is today. c. Bond X has the greatest reinvestment risk. d.

Chapter 16 TF Flashcards - Quizlet An advantage of the zero coupon bond is that there is no coupon, so the yield to maturity is locked in for the life of the bond. T. A floating rate bond has a reasonably stable price, but actual interest payments received change often over the life of the bond. F.

Advantage of zero coupon bonds

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. This makes typical bonds a great source of income, though it limits their capital appreciation if & when bond yields fall (as they often do during recessions, deflation & strong disinflation). Bond yields & price move inversely. The Pros and Cons of Zero-Coupon Bonds Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. Zero-Coupon Bonds: Definition, Formula, Example ... Advantage of Zero-Coupon Bonds From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations.

Advantage of zero coupon bonds. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Zero Coupon Bonds What are the advantages and ... 7. Zero-Coupon Bonds What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? "Low-coupon bonds and zero-coupon bonds arelong-term debt securities that are issued at a deep discount from par value. Investors aretaxed annually on the amount of interest earned, even though much or all of the interestwill not be received until maturity. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons. Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment.

Zero Coupon Bonds What are the advantages and ... 1. Zero-Coupon Bonds. What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest expense for federal income tax purposes, which adds ... Zero Coupon Bond - WallStreetMojo Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is ... Zero-Coupon Bonds: Definition, Formula, Example ... Advantage of Zero-Coupon Bonds From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations. The Pros and Cons of Zero-Coupon Bonds Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. This makes typical bonds a great source of income, though it limits their capital appreciation if & when bond yields fall (as they often do during recessions, deflation & strong disinflation). Bond yields & price move inversely.

Post a Comment for "41 advantage of zero coupon bonds"